What is Money?

Before we move on to QE, we need to know types of money that we denote.

Money can be typically measured M0 (C), M1, M2, M3.

They are simply measured my liquidity (How easily converted into CASH) by ascending orders

– M0 or C: Currency (Cash in Hands)

– M1: M0 + Demand Deposits (Checkable Deposits)

– M2: M1 +Savings Deposits, Money Market Mutual Funds and Other Time Deposits

“Near Money” – Can be quickly converted into Cash or Checking Deposits (M1) BUT Less liquid & NOT suitable as exchange mediums

– M3: M2 + Large Time Deposits, Institutional Money Market Funds, Short-term Repurchase Agreements & Other Larger Liquid Assets

In Economics, we usually call M1 as Money.

Liquidity?

Market Liquidity

The ease with which an asset can be converted into a liquid medium eg) Cash

How easily the assets can be converted into cash?

Funding Liquidity

The ease with which borrowers can obtain external funding

Accounting Liquidity

The health of an institution’s balance sheet measured in terms of its cash-like assets

Too much Liquidity (Cash Abundant)

– Inflation

– Hyperinflation

Shortage of Liquidity (Cash Shortage)

– Fall in Asset Prices BELOW their LR fundamental prices

– Deterioration in External financing conditions

– Difficulty in trading assets

Money Demand

Demand for money is affected by two factors

1. Nominal Income ($Y) – More you earn, more you spend (need money) (+ve Correlation)

2. Interest Rate (L(i)) – Higher the interest rate, more incentive to save, more cost to borrow (-ve Correlation)

Money Supply

Supply of Money is set by the Central Banks and their decisions affects other economic entities via various channels

Major Players

– Central Bank (Banks’ Bank)

– Commercial Banks

– Depositors

– Borrowers from Banks

Monetary Base (Central Bank Money / High-Powered Money)

Monetary Base (H) is money issued by the central bank

CU = Currency

R = Reserves >= Deposits x Required Reserve Ratio

H = Monetary Base = CU + R

So the central bank’s role is using H to control country’s money supply and set the interest rate

Required Reserve Ratio?

The minimum required ratio that commercial banks must keep (i.e. NOT lending it to others), in case of bank run like crisis

Tools of Central Banks

1. Open Market Operations

2. Discount Loans (Discount Window)

3. Required Reserve Ratio

4. Quantitative Easing

1. Open Market Operations

– Standard Methods for Central Banks use to change Money Stock (CU) in modern economics

– Take place in the “Open Market” for bonds (T-Bills)

Expansionary Open Market Operations

– Increase in Money Supply

– Central Bank buys bonds

Contractionary Open Market Operations

– Decrease in Money Supply

– Central Bank sells bonds

Advantages

– Central Bank has complete control over the volume of transactions

– Flexible and Precise (You can keep buy & sell until you reach the target)

– Easily reversed

– Implemented quickly

Disadvantages

– Zero lower bound of nominal interest rate (Liquidity Trap)

(When ‘i’ reaches 0, this approach is not effective to ensure liquidity)

2. Discount Loans (Discount Window)

– Lenders of Last Resort use to provide liquidity to commercial banks (Mainly for short term)

– Normally when liquidity is desperately required, the interest hikes rapidly

– Central bank offers at discounted rate (BUT higher than pre-crisis rate) unlimited borrowing (until market confidence restores upon crisis)

Advantages

– Lenders of Last Resort – Prevent Financial Panics very fast (after 911 terror & market crashes)

Disadvantages

– Confusion in interpreting discount rate changes

– The volume of discounted loans is not fully controlled by FED

3. Reserves Requirement

– Central Bank change “Required Reserve Ratio” (the minimum required reserves)

Advantages

– Powerful Effect (Just need to announce the ratio)

Disadvantages

– May Overshoot, NOT Precise (due to Money Multiplier)

– Raising causes liquidity problems for banks (May force banks to sell illiquid assets)

– Frequent changes cause uncertainty for banks (so banks may want to hold more than its Required Reserve)

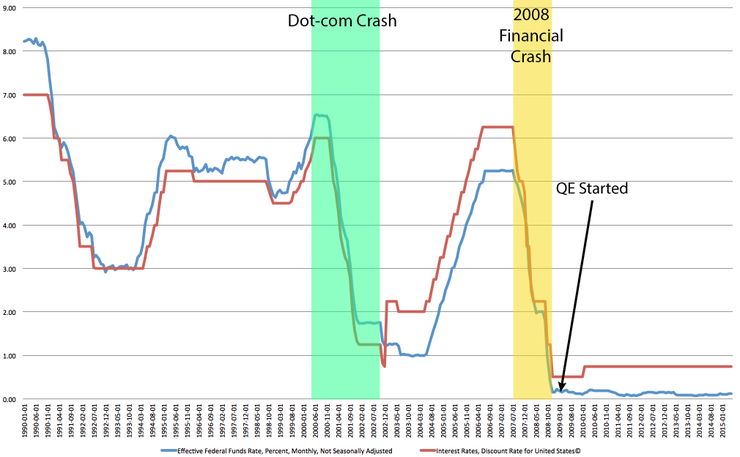

4. Quantitative Easing (QE)

– Central Bank buys financial assets from private sectors (commercial banks & institutions)

– Purchased Financial Assets are not the assets that it would not usually buy in Open Market Operations)

– Money Supply increases –> Lower down the market interest rate

– An unconventional tool used when short-term interest rates are close to zero

(During the 2008 Financial Crisis, US FED bought bank debt (so the commercial bank won’t bankrupt + lowers commercial bank’s rate), mortgage-backed securities (MBS) and long-term government bonds)

QE vs OMO

QE is operating with more risky assets and hence QE can be useful when OMO is NOT working

Advantages

– Flexible

– Not constrained by zero lower bound of nominal interest rate

Disadvantages

– Create bad incentives for the banking system (MORAL HAZARD – Buy risky assets)

– Tapering (Unloading the effects) may cause damage to the economy